We will keep you informed on what’s happening at Monarch.

Monarch Private Capital and Elawan Energy Announce Substantial Completion of Two Renewable Energy Projects

Apr 23, 2024

Monarch Private Capital, a nationally recognized impact investment firm that develops, finances, and manages a diversified portfolio of projects generating both federal and state tax credits, and Elawan Energy, a […]

NC State Renewable Energy Tax Credits Available Through Monarch Private Capital

Apr 5, 2024

Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances and manages a diversified portfolio of projects that generate both federal and state tax credits, announces the […]

Monarch Private Capital Secures Agreement with North Carolina Department of Revenue Honoring All NC Renewable Energy Tax Credits Reported by Monarch’s Investors

Mar 19, 2024

Monarch Private Capital, a leading impact investment firm renowned for its development, financing, and management of a diversified portfolio of projects generating federal and state tax credits, announced today that […]

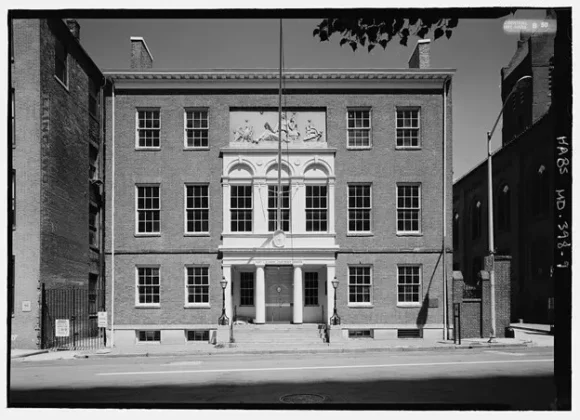

The Peale Wins 2024 Buildy Award

Mar 8, 2024

The Peale Center for Baltimore History and Architecture (The Peale) brings new life to the first purpose-built museum in the Americas, both architecturally and organizationally. The Peale’s National Historic Landmark building was […]

Monarch Private Capital Concludes a Successful Year of Growth and Innovation in 2023

Feb 28, 2024

Monarch Private Capital, a nationally recognized impact investment firm specializing in the development, financing, and management of projects generating federal and state tax credits, proudly announces an exceptional conclusion to […]

Monarch Private Capital Finances the Rehabilitation of Historic Landmark in New Orleans

Feb 26, 2024

Redevelopment of historic landmark to breathe new life into iconic Bank of New Orleans Building Monarch Private Capital, a nationally recognized impact investment firm that develops, finances, and manages a […]

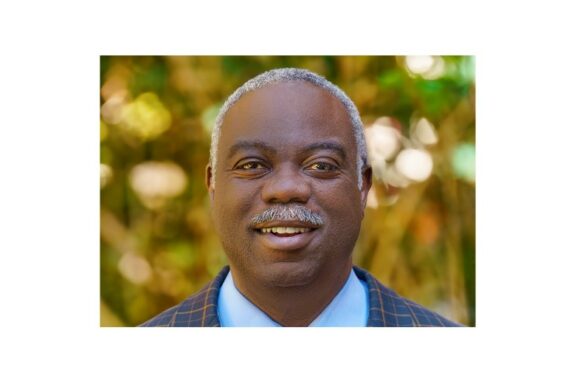

Monarch Private Capital Welcomes Walter L. McLeod as Managing Director

Feb 12, 2024

Monarch Private Capital, a nationally recognized impact investment firm specializing in the development, financing, and management of projects generating federal and state tax credits, proudly announces the appointment of Walter […]

Monarch Private Capital Explores Corporate Sustainability

Jan 15, 2024

Monarch Perspectives Podcast Episode 4: Evolution of Corporate Sustainability Efforts Join Rick, Steve, and special guest Melanie Frontczak, Monarch’s Director of ESG & Tax Credit Investments, as they unravel the […]

Monarch Private Capital Launches Its Own Podcast, Monarch Perspectives

Nov 30, 2023

New podcast series offers insight for investors and developers interested in tax credits and tax equity investing Monarch Private Capital, a nationally recognized impact investment firm that develops, finances, and […]